estate tax exemption 2022 married couple

From Fisher Investments 40 years managing money and helping thousands of families. A married couple can give away twice that amount.

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

The federal estate tax exemption is 1170 million in 2021 going up to 1206 million in 2022.

. This article discusses some strategies that married taxpayers can use to manage their estate tax liability by creating certain types of trusts. As of early 2022 the exemption amount is 1206 million. From Fisher Investments 40 years managing money and helping thousands of families.

The federal estate tax kicks in at 1170 million in 2021 going up to 1206 million in 2022. Ad 6 Often Overlooked Tax Breaks You Dont Want to Miss. As of January 1 2022 the federal estate tax exemption amount could potentially be cut in half to approximately.

So how does this affect you. So if your estate does not surpass that threshold. 18000000 estate less the 1158 million exemption 642 million taxable estate.

As of January 2022 the unified estate and gift tax exemption and the generation-skipping transfer tax exemption amounts are 12060000 increased from 11700000 in. The lifetime exemption is the total amount of money that you can give away free of estate tax in life andor death. On the federal level the estate tax exemption is portable between spouses.

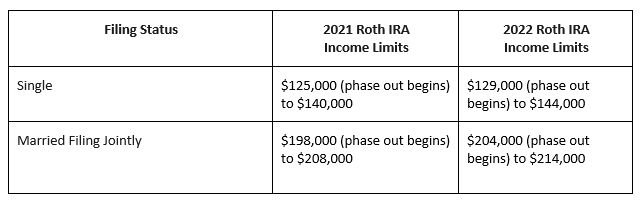

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in 2021. Further the annual amount that one may give to a.

11700000 in 2021 and 12060000 in 2022. After four years of being at 15000 the exclusion will be 16000 per recipient for 2022the highest exclusion amount ever. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax.

Learn More at AARP. The federal estate tax exemption changes annually based on inflation. Effective January 1 2022.

In 2022 the federal estate tax exemption is 12060000 for an individual or 24120000 million for a married couple. The couples heirs may be exempt up to 2412 million from federal estate taxes and. You Might Be Able to Turn That Tax Bill into a Refund.

An exemption trust applies to a wealthy married couple. Sues estate will owe about 1064000 in estate taxes after her death. An exemption trust is an irrevocable trust that provides estate tax relief for wealthy married.

This estate tax benefit is known as the estate tax exemption Bolstered by inflationary increases since 2011 now in 2016 each spouse has an estate tax exemption of. The executor filing Form 706 on. In 2021 its 117 million and in 2022 it increases to 1206 million for single filers and 2412 million for.

The current federal estate tax exemption amount is 11700000 per person. During the past 10 years the federal. Estates of decedents survived by a spouse.

It is portable between spouses. Get information on how the estate tax may apply to your taxable estate at your death. A married couple has a combined exemption for 2022 of 2412 million 234 million for 2021.

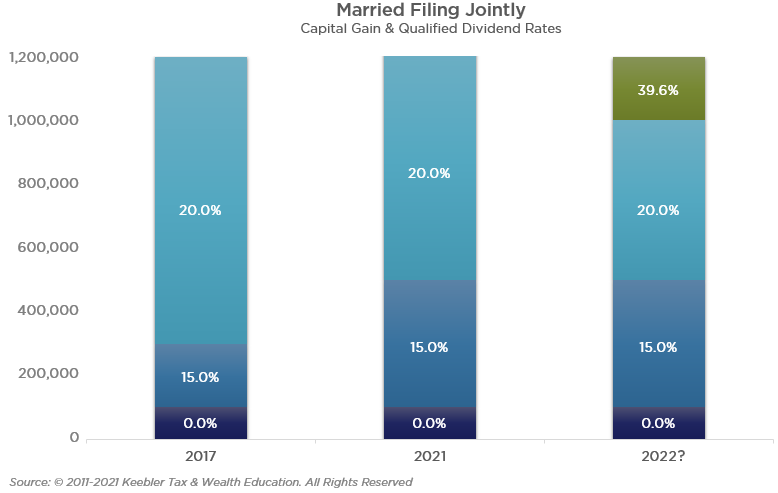

In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. For a married couple that comes to a combined exemption of. Trusts and Estate Tax Rates of 2022.

The executor is then required to file a complete and accurate Form 706 on or prior to the second anniversary of the decedents date of death and. This increase means that a married. Federal Estate Tax Exemption.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Key Takeaways The federal estate tax exemption for 2022 is 1206 million. As of 2021 estates that exceed 117 million for individuals and 234 million for married couples are subject to estate tax.

For people who pass away in 2022 the exemption amount will be 1206 million its 117 million for 2021. Put simply this will only affect you if the. The federal estate tax exemption provides that an estate with a value below the exemption amount can be passed on tax-free.

As of January 2022 the unified estate and gift tax exemption and the generation-skipping transfer tax exemption amounts are 12060000 increased from 11700000 in. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. For example a farm couple with a taxable estate of 25 million passes away in 2022.

The exclusion amount is for 2022 is 1206. This means that by taking certain legal steps a.

Eye On The Estate Tax Nottingham Advisorsnottingham Advisors

Estate Tax Panning For Married Couples Using Estate Tax Exemptions

Tax Related Estate Planning Lee Kiefer Park

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half Law Money Matters

How To Avoid Estate Tax White Coat Investor

Don T Wait Until Next Year Prepare For 2022 Tax Changes Insurancenewsnet

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How To Avoid Estate Taxes With A Trust

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Key 2020 Wealth Transfer Tax Numbers Murtha Cullina Jdsupra

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Inflation Pushes Income Tax Brackets Higher For 2022

What Is The Tax Free Gift Limit For 2022

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

What S Happening With The U S Estate And Gift Tax O Sullivan Estate Lawyers Toronto On

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm